The sequester is creating confusion for aerospace and defense investors this year. However, confusion tied to the impact of defense budgets on aerospace suppliers may present opportunity given military spending is historically lumpy and strong commercial aerospace demand provides long-term tailwinds.

If so, one aerospace supplier worth consideration is Esterline Technologies (ESL), a company with reach into key military programs such as the upcoming Airbus A400M, and commercial programs, such as the top selling Airbus 320.

The company operates three segments

1. Advanced Materials - defense technologies and engineered materials.

2. Sensors and Systems - advanced sensors, connectors and power systems.

3. Avionics and Controls - avionics systems, communication systems, control systems and interface technologies.

Esterline's sales are geographically diversified, with 50% coming from the United States and the remainder generated abroad.

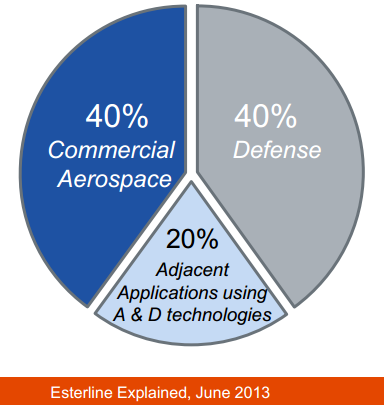

Approximately 40% of the company's business comes from the commercial aerospace sector, 40% from defense spending and the remaining 20% come from adjacent industrial markets including railroads and gaming.

Headwinds to overcome

Despite having nicely balanced revenue between defense and commercial and overseas and domestic businesses, Esterline's biggest hurdle remains defense spending.

Specifically, two programs are creating challenges for the company.

The first is slowing production for the Beechcraft T-6B training aircraft for the Navy. Esterline produces the cockpit systems for the aircraft and sales are slipping as Beechcraft cuts annual production from 49 to 42 planes.

Production is unlikely to rebound given Beechcraft lost a contract for its next generation AT-6 training aircraft to Embraer (ERJ) in 2012, which helped push the aircraft maker into bankruptcy.

Since, a suit against the Pentagon prompted a re-bid, which again resulted in Embraer winning - throwing fresh doubt on future production.

A second program, the Global Hawk UAV, has also stumbled.

The US Air Force may retire its fleet of the Northrop Grumman (NOC) made UAV's to refocus on the aging, yet tried-and-true U-2 surveillance aircraft. The end of the Global Hawk program impacts demand for Esterline's signal intelligence receivers.

But it's not all bleak for Esterline in defense.

Offsetting those headwinds is growth tied to Airbus' A400M, which generates $1.2 million in value for Esterline per ship set.

The A400M owns 32% of global orders for heavy lift aircraft with deliveries beginning this year. Airbus hopes to build 2.5 per month by 2015, which means its current backlog won't be worked through for six years.

Esterline also generates about $900,000 per ship set from the F-35 Joint Strike Fighter. The next generation 1,100 mile per hour fighter will cost the Pentagon $391 billion for 2443 planes over time. The plane will also be a staple of western ally fleets as F-16s and Harrier's are retired.

And Esterline also has opportunity in Boeing's (BA) P-8 maritime surveillance aircraft, from which it gets about $1 million in business per ship set. The P-8 Poseidon is based on Boeing's 737-800, with its first delivery occurring last year. In September 2012, the Pentagon ordered another 11 P-8s for $1.9 billion.

Commercial aerospace is the real reason to consider buying shares

At the Paris Air Show in June, both Airbus and Boeing walked away with significant orders to add to their already bulging backlogs.

Airline operators ordered 466 planes worth more than $70 billion from Airbus. Those orders add to an existing backlog of 4,928 planes at the end of May.

Boeing announced orders for 442 planes worth $66 billion, lifting Boeing's year-to-date net orders to 692 planes. Boeing's backlog was north of 4,400 exiting this past spring.

These orders add pressure to curb the swelling production by boosting production. Airbus is building 42 A320s per month, up from 34 in 2010. Boeing plans to lift 737 production to 42 this year. As a result, both companies may deliver a record number of planes this year.

Esterline's commercial programs include the Boeing 787 and 737 and Airbus A320. So, ramping production will help fuel growth.

"At the outset of this year, I said, much like our fiscal 2012, we will build to a strong finish. This still holds. And there are a number of favorable trends that we expect to continue to a strong back half of the year, including continuing strength in our commercial aerospace OEM business, particularly for single-aisle platforms, steady margin performance, a solid $1.3 billion backlog, continued strong cash flow and, throughout the business, an effective focus on cost controls," said Richard Bradley Lawrence, CEO, during the FYQ2 EPS conference call in May.

And Esterline's R&D is focused on winning share in future programs including Boeing's 737 MAX and Airbus's A350, offering additional opportunity.

Add to this backdrop a potential pickup in aftermarket demand tied to pent-up maintenance and rising revenue passenger miles, and you get a solid long-term opportunity for growth.

"Fortunately, the near-term strength in the global commercial aerospace cycle remains very positive with respect to the outlook for high levels of passenger load, which bodes well for spares and aftermarket business, and a strong appetite for new, fuel-efficient aircraft, which bodes well for our OEM business," said Mr Lawrence.

By the numbers

Since 2002, the company's sales have grown a compounded 17.8% annually and free cash flow has increased from a pre recessionary trough of $11 million in 2006 to $145 million in 2012.

Despite the defense headwinds, company wide FYQ2 sales of $500 million were only just shy of the $505 million from a year ago. For the first six months of the fiscal year, sales were 2% lower year-over-year.

But, even with lower sales reducing margin leverage against fixed costs, gross margins stayed in check. In the fiscal second quarter they were 36.3%, down only slightly from 36.6% a year ago. And, fiscal year-to-date, gross margins are up slightly to 35.7% from 35.1%.

The stability in margin reflects ongoing focus on right sizing budgets. Such cost conscious management should pay off as higher margin aftermarket sales rebound.

The final take

Shares are trading a reasonable 1.22 times sales and 1.44 times book value. More interesting, shares are trading just 12.9 times forward earnings estimates, well below the 23 times investors are currently paying on trailing 12 month earnings.

Given the company has plenty of content shipping into high demand new military and commercial aircraft programs, flattening sales this year may prove a short-term concern. If so, investors stepping into shares this quarter may be rewarded over the coming one to two years.

Additional Source Material: Investor Presentation

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in ESL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

channing tatum Jennifer Aniston naomi watts Oscar Nominations 2013 Beasts of the Southern Wild 2013 Oscars academy awards

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.